The Ultimate Guide To Pacific Prime

Insurance coverage additionally aids cover costs connected with liability (legal obligation) for damage or injury triggered to a 3rd event. Insurance policy is an agreement (policy) in which an insurance provider compensates another against losses from details contingencies or dangers. There are many kinds of insurance coverage. Life, wellness, property owners, and vehicle are amongst one of the most typical types of insurance.

Investopedia/ Daniel Fishel Many insurance plan types are available, and basically any kind of specific or business can locate an insurer ready to insure themfor a cost. Usual personal insurance coverage kinds are automobile, health, property owners, and life insurance coverage. Many individuals in the USA have at the very least among these sorts of insurance coverage, and cars and truck insurance coverage is needed by state legislation.

Some Known Incorrect Statements About Pacific Prime

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)

Finding the cost that is appropriate for you needs some legwork. Maximums might be set per duration (e.g., annual or plan term), per loss or injury, or over the life of the plan, also known as the lifetime maximum.

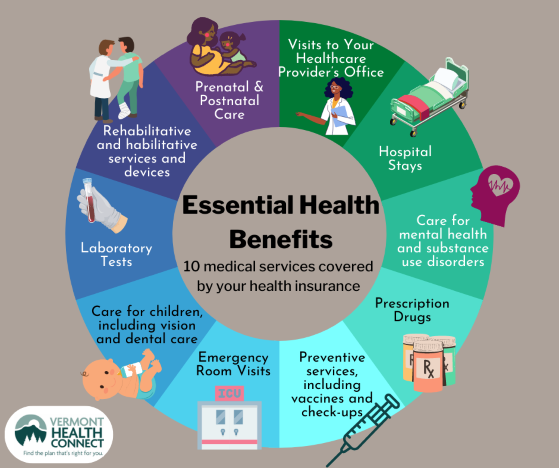

Policies with high deductibles are typically more economical since the high out-of-pocket expenditure generally causes fewer small claims. There are several various kinds of insurance. Allow's look at one of the most vital. Medical insurance assists covers routine and emergency situation clinical care expenses, usually with the alternative to include vision and oral solutions individually.

Numerous preventative services might be covered for totally free before these are fulfilled. Wellness insurance coverage may be bought from an insurance company, an insurance coverage agent, the federal Wellness Insurance coverage Marketplace, provided by a company, or federal Medicare and Medicaid protection.

Pacific Prime - An Overview

Rather of paying out of pocket for vehicle crashes and damages, people pay yearly costs to an automobile insurance provider. The company then pays all or the majority of the covered prices associated with an auto crash or various other automobile damage. If you have a rented car or obtained money to acquire a vehicle, your lender or renting dealer will likely need you to lug car insurance.

A life insurance plan guarantees that the insurance provider pays a sum of money to your recipients (such as a spouse or children) if you die. In exchange, you pay costs during your lifetime. There are two main sorts of life insurance coverage. Term life insurance covers you for a certain duration, such as 10 to two decades.

Long-term life insurance policy covers your entire life as long as you proceed paying the premiums. Travel insurance covers the expenses and losses connected with taking a trip, including trip cancellations or hold-ups, coverage for emergency situation health and wellness treatment, injuries and emptyings, damaged luggage, rental vehicles, and rental homes. Nevertheless, also a few of the finest traveling insurer - https://young-nemophila-a7b.notion.site/Pacific-Prime-Your-Partner-for-Comprehensive-Insurance-Solutions-7ea95e6a0f4e46d6a51631c55774899a?pvs=25 do not cover cancellations or hold-ups as a result of weather, terrorism, or a pandemic. Insurance coverage is a method to manage your financial threats. When you acquire insurance policy, you acquire security versus unforeseen monetary losses.

Indicators on Pacific Prime You Should Know

Although there are many insurance coverage types, some of one of the most usual are life, wellness, home owners, and automobile. The right sort of insurance for you will certainly depend on your objectives and monetary situation.

Have you ever before had a moment while checking out your insurance coverage plan or buying insurance coverage when you've assumed, "What is insurance? And do I actually need it?" You're not alone. Insurance coverage can be a mystical and puzzling point. Just how does insurance policy work? What are the benefits of insurance? And exactly how do you discover the most effective insurance coverage for you? These prevail concerns, and thankfully, there are some easy-to-understand solutions for them.

No one wants something poor to happen to them. However enduring a loss without insurance coverage can place you in a tough economic situation. Insurance policy is an important economic tool. It can assist you live life with less fears knowing you'll get financial support after a calamity or crash, assisting you recover much faster.

The smart Trick of Pacific Prime That Nobody is Discussing

And in some situations, like auto insurance policy and workers' settlement, you might be needed by law to have insurance coverage in order to shield others - global health insurance. Find out regarding ourInsurance choices Insurance policy is basically a big nest egg shared by lots of people (called policyholders) and taken care of by an insurance policy carrier. The insurance coverage business makes use of money gathered (called costs) from its insurance holders and other his response financial investments to pay for its operations and to fulfill its guarantee to insurance holders when they sue